All Categories

Featured

Table of Contents

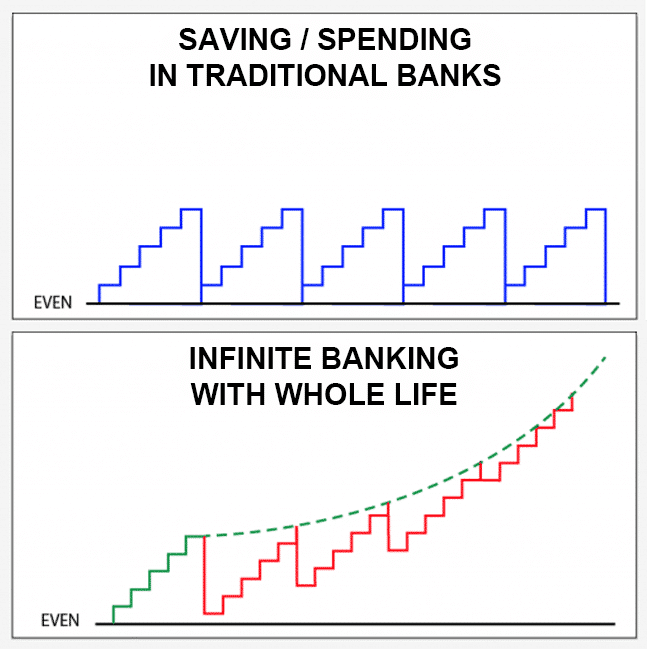

For most individuals, the greatest trouble with the boundless banking principle is that first hit to early liquidity brought on by the prices. Although this con of unlimited banking can be minimized considerably with proper plan design, the first years will always be the most awful years with any Whole Life policy.

That said, there are particular infinite financial life insurance policy plans designed mainly for high early money value (HECV) of over 90% in the very first year. The long-term performance will typically significantly lag the best-performing Infinite Financial life insurance coverage policies. Having access to that additional 4 figures in the very first couple of years may come with the cost of 6-figures later on.

You really obtain some substantial long-lasting benefits that aid you recoup these early prices and then some. We find that this hindered very early liquidity trouble with infinite banking is extra mental than anything else when thoroughly discovered. In truth, if they absolutely needed every cent of the cash missing out on from their infinite financial life insurance coverage plan in the very first few years.

Tag: limitless financial principle In this episode, I talk regarding funds with Mary Jo Irmen that instructs the Infinite Banking Concept. With the increase of TikTok as an information-sharing system, monetary guidance and strategies have found an unique method of spreading. One such method that has been making the rounds is the unlimited banking principle, or IBC for short, garnering recommendations from celebrities like rap artist Waka Flocka Flame.

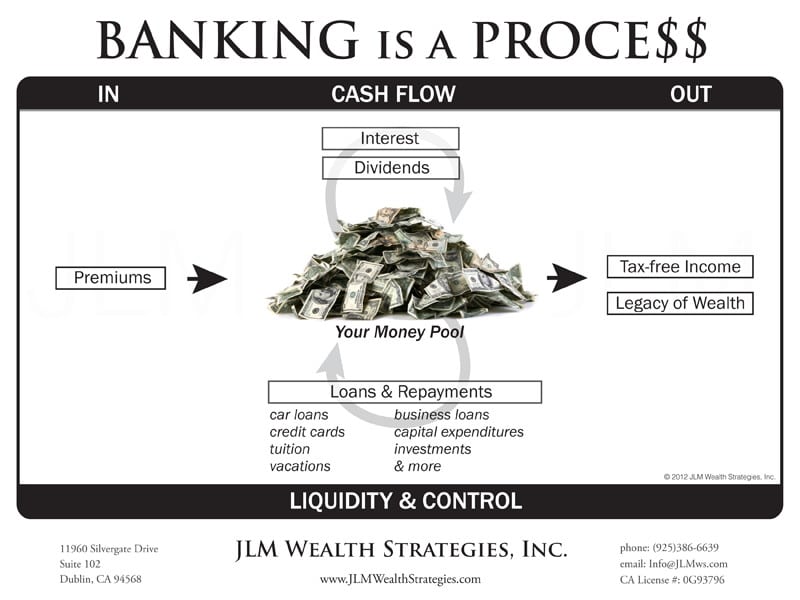

Within these policies, the money worth expands based upon a rate set by the insurer. As soon as a significant cash value gathers, insurance holders can obtain a cash worth finance. These lendings vary from conventional ones, with life insurance policy working as collateral, meaning one could lose their coverage if loaning exceedingly without adequate money value to support the insurance policy expenses.

And while the attraction of these plans is noticeable, there are innate limitations and dangers, requiring persistent cash money value tracking. The method's legitimacy isn't black and white. For high-net-worth people or business owners, especially those utilizing approaches like company-owned life insurance coverage (COLI), the advantages of tax obligation breaks and substance development could be appealing.

Infinite Banking Toolkit

The allure of limitless financial does not negate its challenges: Expense: The foundational need, a permanent life insurance plan, is costlier than its term counterparts. Qualification: Not everyone gets entire life insurance policy because of extensive underwriting processes that can leave out those with particular health or way of life conditions. Intricacy and threat: The elaborate nature of IBC, paired with its risks, may prevent several, especially when easier and less dangerous options are offered.

Designating around 10% of your regular monthly earnings to the plan is simply not practical for most people. Making use of life insurance policy as a financial investment and liquidity source calls for technique and surveillance of policy money worth. Speak with a financial expert to establish if infinite financial aligns with your concerns. Part of what you read below is merely a reiteration of what has actually already been stated over.

Prior to you get on your own into a situation you're not prepared for, know the complying with first: Although the principle is commonly sold as such, you're not in fact taking a funding from yourself. If that held true, you wouldn't need to repay it. Rather, you're obtaining from the insurer and have to repay it with interest.

Some social media blog posts recommend using money value from whole life insurance policy to pay for bank card debt. The idea is that when you pay back the loan with passion, the amount will certainly be sent back to your investments. However, that's not how it works. When you pay back the loan, a part of that rate of interest goes to the insurance policy firm.

For the first several years, you'll be paying off the commission. This makes it exceptionally challenging for your plan to gather worth during this time. Unless you can pay for to pay a few to several hundred bucks for the next years or even more, IBC won't work for you.

Nelson Nash Infinite Banking

Not everybody needs to depend entirely on themselves for financial safety and security. If you require life insurance policy, here are some beneficial suggestions to think about: Consider term life insurance policy. These plans supply insurance coverage during years with substantial financial commitments, like home loans, pupil financings, or when looking after children. See to it to look around for the ideal rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Call "Montserrat". This Font Software is certified under the SIL Open Up Font Style Permit, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Name "Montserrat". This Font style Software application is accredited under the SIL Open Up Font Style License, Version 1.1.Avoid to main content

Infinite Banking Illustration

As a CPA concentrating on actual estate investing, I've brushed shoulders with the "Infinite Banking Concept" (IBC) much more times than I can count. I've also interviewed professionals on the subject. The main draw, in addition to the obvious life insurance policy benefits, was always the concept of accumulating cash money value within a permanent life insurance policy plan and loaning versus it.

Sure, that makes feeling. Honestly, I constantly assumed that money would certainly be much better spent straight on financial investments rather than funneling it through a life insurance coverage policy Till I uncovered how IBC can be incorporated with an Irrevocable Life Insurance Count On (ILIT) to create generational riches. Allow's begin with the essentials.

Banker Life Quotes

When you obtain versus your plan's money worth, there's no collection settlement timetable, offering you the freedom to handle the lending on your terms. At the same time, the money worth remains to expand based on the policy's guarantees and rewards. This arrangement permits you to accessibility liquidity without interrupting the lasting growth of your plan, supplied that the lending and passion are managed wisely.

The procedure proceeds with future generations. As grandchildren are birthed and mature, the ILIT can purchase life insurance policy plans on their lives as well. The depend on then collects multiple plans, each with growing cash worths and death advantages. With these policies in position, the ILIT properly ends up being a "Family Financial institution." Member of the family can take lendings from the ILIT, using the cash value of the policies to money investments, begin businesses, or cover significant costs.

A vital element of handling this Household Financial institution is making use of the HEMS criterion, which means "Health, Education And Learning, Upkeep, or Assistance." This guideline is typically consisted of in trust fund contracts to route the trustee on how they can disperse funds to beneficiaries. By adhering to the HEMS standard, the trust fund makes certain that distributions are produced necessary needs and long-lasting support, safeguarding the depend on's properties while still attending to relative.

Increased Adaptability: Unlike rigid financial institution lendings, you regulate the payment terms when obtaining from your own plan. This enables you to framework repayments in a means that straightens with your company cash circulation. royal bank infinite avion redemption. Improved Capital: By financing overhead via policy fundings, you can possibly maximize cash money that would certainly or else be tied up in typical loan repayments or tools leases

He has the exact same equipment, yet has also constructed added money value in his policy and received tax obligation benefits. Plus, he currently has $50,000 offered in his policy to utilize for future chances or expenses. Regardless of its prospective benefits, some people remain unconvinced of the Infinite Banking Principle. Let's resolve a couple of common issues: "Isn't this simply pricey life insurance policy?" While it holds true that the costs for a properly structured entire life policy might be more than term insurance policy, it is very important to view it as even more than just life insurance.

Bioshock Infinite Vox Cipher Bank

It has to do with creating a versatile financing system that offers you control and supplies several benefits. When made use of strategically, it can match other investments and business methods. If you're intrigued by the potential of the Infinite Banking Idea for your organization, below are some actions to think about: Enlighten Yourself: Dive much deeper right into the idea through trusted publications, workshops, or appointments with well-informed experts.

Latest Posts

How To Take Control Of Your Finances And Be Your Own ...

Whole Life Banking

Infinite Banking Book